Financial Planning is an important activity focused on determining your needs and setting practical goals such as funding retirement, sending a child to college, or perhaps the purchase of a home. A financial professional can help you develop short-term and long-term goals designed to aid you in accomplishing these financial objectives. But is there value in paying for investment guidance?

The value of guidance and advice provided by a licensed and trained financial professional is hard to quantify. For some, the convenience of letting someone else handle the complexities of investing is invaluable. For others, professional advice and guidance can help provide a sense of financial security.

Prudent investing is based on the patient, disciplined application of a plan. In addition to helping you develop the plan, an experienced financial professional has an understanding of how markets have historically performed, the value of compounding, and the implications and consequences of taxes. Milestones in life often require the assistance of a professional, just as an illness might require a doctor’s advice and care.

Together, you and your financial professional can navigate the increasingly complex world of investing and financial planning.

{beginAccordion}

About CUE Financial Group

Your credit union’s financial partner, CUE Financial Group1 offers financial consulting and investment services. CUE’s financial representatives can help you with more complicated financial needs such as retirement planning or achieving your personal financial goals. They also hold educational seminars through the credit union or at companies affiliated with the credit union.

CUE Financial Group offers a wide range of products and services. They do not represent one product provider; rather, they can help you choose from a variety of providers to find the one that best fits your needs, including:

- Mutual funds

- Annuities

- Stocks

- Bonds

- Individual Retirement Accounts & Tax-Sheltered Annuities

- Insurance services (life, long-term care, etc.)

Contact CUE

Visit cuefinancialnm.com for more information about our services.

Daniel Garton

4910 Union Way NE

Albuquerque, NM 87107

Phone: 505-462-1056 • 505-440-0476

Fax: 505-768-7123

[email protected]

John Garton

4910 Union Way NE

Albuquerque, NM 87107

Phone: 505-768-7155 • 505-250-0044

Fax: 505-768-7123

[email protected]

{endAccordion}

Article from CUE Financial Group

{beginAccordion}

The Price of Procrastination

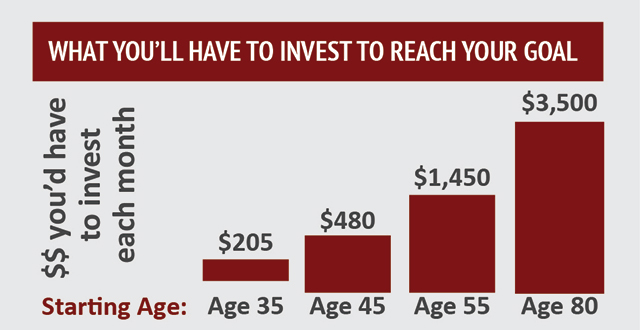

Even a small delay in implementing your financial plan can have monumental results. For example, a 35 year old man has $10,000 to invest in an IRA. If he made no further contributions and the account grew at a hypothetical 7% return for 30 years – until he retired at age 65 – it would be worth $81,160. That’s because compound and tax-deferred interest have enough time to work their magic. But just waiting 10 years to invest that same $10,000 can be costly. Assuming the same IRA at the same 7% return, the money grows for only 20 years and will be worth $40,380. Let’s look at it from another angle – investing on a monthly basis. Let’s assume you want to retire at age 65 with a nest egg of 250,000. Assuming a hypothetical 7% return, how much would you have to put aside each month to reach your goal?

The above illustration assumes an 7% hypothetical rate of return in a taxdeferred account during selected time periods. Such a rate of return for every time period is very unlikely. Rates of return will vary over time. This example is not intended as an indication of the actual performance of any fund or investment.

Developing and implementing a financial plan now could dramatically increase your chances of attaining your financial goals later on.

As you see, it’s important to understand the many variables of investing and financial planning, and deciding on a course of action can seem overwhelming. The value added guidance provided by a qualified financial professional is incalculable. Taking that first step to partner with someone who can help you with those decisions should provide you with an increased comfort level and the knowledge that, together, you’re both working toward the same goal – your financial independence. Let’s start targeting your strategy today!

{endAccordion}

CLICK HERE FOR A COPY OF PFG ADVISORS' RELATIONSHIP SUMMARY (FORM CRS).

CLICK HERE FOR A COPY OF OSAIC WEALTH, INC'S., RELATIONSHIP SUMMARY (FORM CRS).

Free and simple tools are available to research firms and financial professionals at INVESTOR.GOV/CRS, which also provides educational materials about broker-dealers, investment advisors, and investing.