Nominations for Directors and Annual Meeting Notice

{beginAccordion}

Read More

As directed by the bylaws of First Financial Credit Union, a Nominating Committee has been appointed to carry out the election of the Board of Directors. The Committee has the following proposed candidates for three Board positions open for election in February 2025. The background and experience of the candidates nominated by the Nominating Committee is provided below.

If a qualified member is not selected by the nominating committee, but wishes to run for an elected office, they may have their name placed on the ballot by submitting a petition which will consist of at least 1% of the membership as established on January 1 of each election year. Petition must be submitted to the appointed tellers for verification and the placing of the member’s name on the ballot. Such petition shall be received by the tellers no later than 45 days prior to the annual meeting (deadline April 22, 2025).

In the event there are more nominees than vacancies to be filled, all candidates and their qualifications will be presented on an official ballot which will be by mail or any other electronic means as determined by the Board of Directors. If there is only one nominee for each vacancy, the nominees will be approved by acclamation.

Nominations for Directors by the Nominating Committee:

Richard Goshorn, FFCU Board member since 2022. I currently serve the FFCU Board as its Secretary Treasurer. I work for UNM as the Director of Business Operations/CFO/CIO/COO for Valencia County Community College. I have been with UNM for 23 years and bring to the credit union Board a portfolio of experience including finance, business services, information technologies, human resources, auxiliary enterprises, facilities management, construction/project management, police, security, and marketing. I currently reside in Bosques Farms, NM with my wife, two children, dogs and geese. I enjoy old vehicle restoration, creative woodworking, fly fishing and boating. I thoroughly enjoy my role on the Board and serving our membership.

Patricia Roughgarden, FFCU Supervisory Committee member since 2022. I have been a volunteer on the Supervisory Committee for the last three and half years. During this time, I had the privilege of serving the members of First Financial Credit Union by working with the Internal Audit team; ensuring activities satisfies the supervisory committee audit and other regulatory requirements. Joining the Board of Directors allows me to contribute my leadership, operations, and engineering skills to help the credit union continue to grow while serving the membership and the community.

Jose Melendez, FFCU Board Associate since 2024. I have been a proud member of FFCU since 2004. I earned a BBA in Accounting from ENMU and hold an EA license. I am a Tax Manager at FWB Company in Clovis. For the past 9 months, I’ve been privileged to serve as an Associate Board member for FFCU. Community Services is a priority in my life serving as a Board Member for La Casa FHC, St. Helens Church, ENMU Foundation. I enjoy time with my wife, and we are thrilled to welcome our first child this summer. I look forward to continuing to support the credit union and its members.

Results of the election will be announced at the Annual Membership Meeting, which will be held on May 30, 2025. No nominations will be accepted from the floor at the Annual Membership Meeting.

Sincerely,

First Financial Nominating Committee

Cassie Kelley, Cindy Frost, Paul Rael, and Jennifer Walters

{endAccordion}

It is important that you provide the correct MICR Number for Direct Deposit & Tax Returns.

{beginAccordion}

Read More

Our goal at FFCU is to ensure your direct deposits or tax refunds post correctly and timely into the account you are intending them to. To avoid any delays or rejects, it is important that you provide the correct MICR Number to your employer (for direct deposit) or your tax attorney/CPA (for tax returns). A MICR Number is your bank account number with preceding digits added that identifies the exact account (Savings, Checking, Auto Loan, Personal Loan) where the funds will be credited/debited. This means that you will have a different MICR Number for each of your FFCU accounts and loans. To support you, we provide the full MICR Number on each of your accounts/loans, with us, via online and mobile banking. Please confirm you are using the correct MICR Number, before authorizing any ACH, Direct Deposit or Payments.

To find the correct MICR Number via ONLINE banking, please follow these steps:

- Log into your online banking

- Click on the account or loan you want your ACH to post to, on the left-hand side.

- Click on Account Details in the middle of the page above your transactions.

- Find MICR ACCOUNT NUMBER at the bottom

- This is exactly what you need to provide to your employer, Tax Attorney or CPA to ensure your payments, deposits and tax returns post on time and to the right account.

To find the correct MICR Number via MOBILE banking, please follow these steps

- Log into your mobile banking

- Click on the account or loan you want the ACH to post to.

- Click on SHOW DETAILS in the upper right-hand corner.

- Find the MICR ACCOUNT NUMBER at the bottom.

If you do not have access to online or mobile banking, please feel free to contact us at (505)766-5600 or visit a branch and our staff will be happy to provide you with information you need. Thank You

{endAccordion}

Wire Transfer vs. ACH Transactions: Key Differences

{beginAccordion}

Read More

We wanted to talk about two very popular money transfer services FFCU offers our members and how they differ. Plus, neither of these services involve using a debit or credit card.

What is a Wire Transfer?

Wire transfers move money electronically from one credit union or bank account to another. They can be domestic (between two U.S. accounts) or between a U.S. and international account. There are usually fees involved with these types of transfers.

What is an ACH transaction?

An ACH transaction is an electronic money transfer made between banks and credit unions across a network called the Automated Clearing House (ACH). ACH is used for all kinds of money transfers, including direct deposit of paychecks and monthly debits for routine payments. For example: When a utility company asks for your bank’s routing and account number to set up automatic monthly payments, this is what you’d call an ACH transaction.

Both wire transfers and ACH transactions are used to send money from one financial institution to another, but they differ in several important ways, including speed, cost, and how they are processed. The below outlines those differences:

Processing Speed

• Wire Transfer

-

- Speed: Funds are deposited by the receiving financial institution same-day or next-day (depending on the time sent and recipient’s financial institution). International wires can take multiple days to be deposited by the receiving financial institution.

- Time of Day: Must be initiated by a specific cutoff time for same-day processing (varies by financial institution). Typically, not processed on weekends.

- Finality: Transactions are final and irreversible once processed.

• ACH Transaction

-

- Speed: Typically takes 1-3 business days to process.

- Time of Day: Transactions are processed in batches at specific intervals.

- Finality: ACH payments can be reversed or corrected in certain cases (e.g., in case of errors or disputes).

Cost

• Wire Transfer

-

- Fees are typically charged to the sender, though sometimes both the sender and recipient may incur fees.

• ACH Transaction

-

- Usually free or low-cost for standard ACH transfers but ACH transfers are generally less expensive than wire transfers.

Use Cases

• Wire Transfer

-

- Best for: Large, urgent transactions, international payments, or time-sensitive transfers.

- Common Uses: Real estate transactions, international money transfers, same-day business payments.

• ACH Transaction

-

- Best for: Routine, non-urgent payments such as direct deposits, bill payments, and recurring transactions.

- Common Uses: Payroll deposits, utility bill payments, loan payments, and subscription services.

Security

• Wire Transfer

-

- Security Level: Very secure due to the involvement of direct bank-to-bank communication. However, once a wire is sent, it is final and cannot be undone, making it a target for fraud if not carefully monitored.

• ACH Transaction

-

- Security Level: Also, highly secure, but offers the potential for reversals if fraud is detected. ACH transactions may be subject to fraud protections, including the ability to dispute transactions.

Availability and Limits

• Wire Transfer

-

- Available for both domestic and international transfers.

- Typically, higher limits are set for wire transfers, but can vary by financial institution.

• ACH Transaction

-

- Primarily available for domestic transfers (within the U.S.).

- Limits are usually lower than wire transfers, though higher limits can be set but will vary by financial institution.

Still trying to decide which you should choose, consider a Wire Transfer if you need to send money quickly, especially internationally or for large amounts that need to be processed on the same or next day and consider an ACH Transaction if you’re making ongoing routine, low-cost transfers, such as paying bills, receiving direct deposits, or sending non-urgent domestic transfers.

{endAccordion}

Removing Email as an Option for Multi-Factor Authentication (MFA)

{beginAccordion}

Read More

Important Notice for Online and Mobile Banking Users: First Financial Credit Union is taking measures to enhance your security for our online and mobile banking platforms. Research shows that passwords alone are more vulnerable to hackers. Adding to that risk is the possibility of your email account being compromised. Therefore, to reduce these risks, First Financial Credit Union is removing the option to send multi-factor authentication (MFA) requests to your designated email. Effective November 5th, 2024, you will no longer be able to send MFA codes to your email.

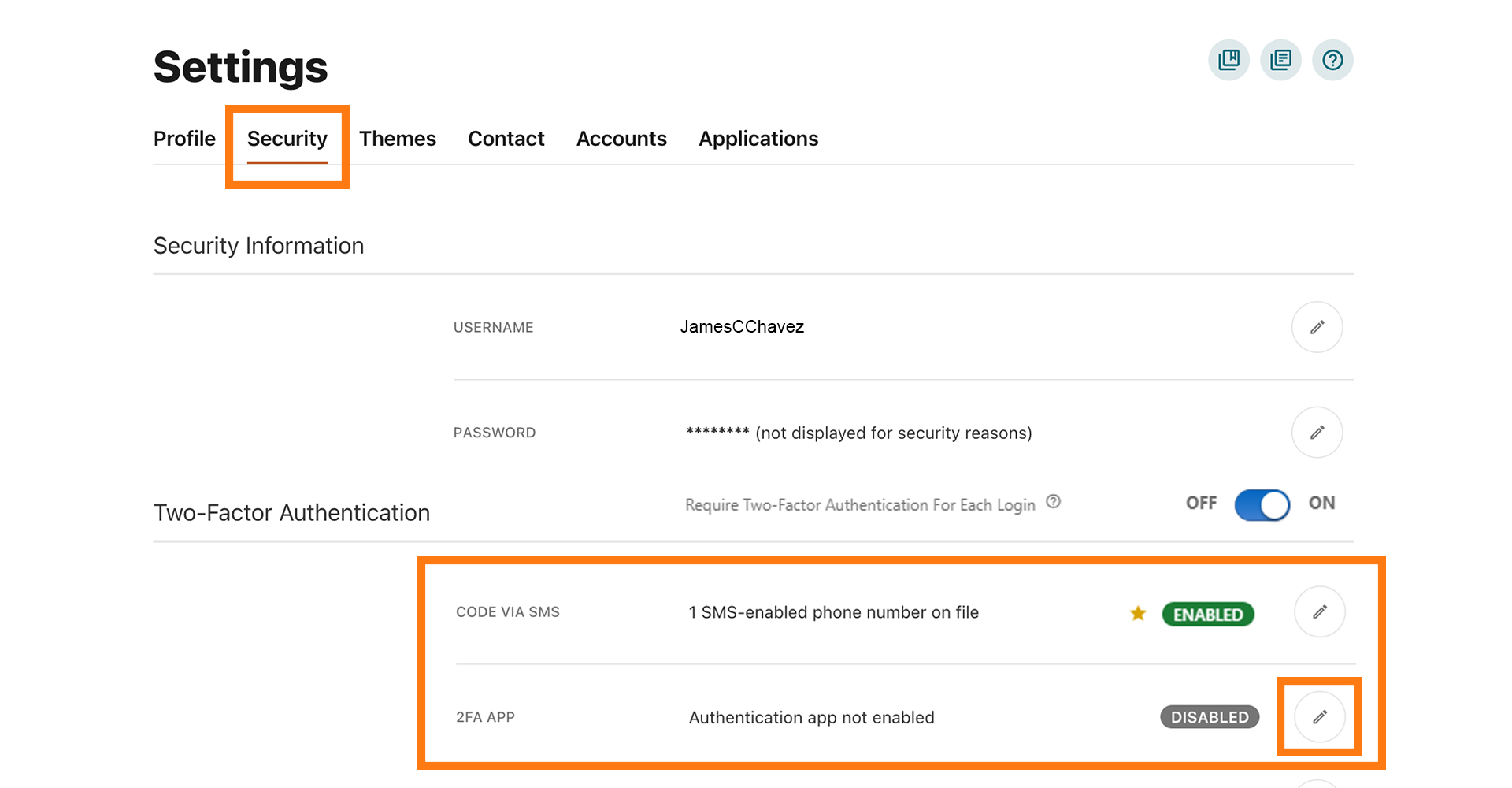

It will be very important to ensure that you have a cell phone number listed in your settings for online and mobile banking as this option will most likely be the easiest. There is another option within our platform that will allow you to use authenticator apps such as Google Authenticator, Authy or Duo as examples.

***Most of our online banking users are already set up to be able to send authentication codes to your cell phone number so it is likely that you will not be impacted by this change.***

For our online and mobile banking platform, we refer to the multi-factor authentication as 2FA. Please refer to the illustrations provided below to ensure you have the proper settings to use either your cell phone number or an authenticator app. If you have any questions, or if you need any assistance, you can reach our Member Resource Center by calling 1-800-342-8298 or 505-766-5600 Monday-Friday 7:30AM-6:00PM or Saturday 9:00AM-3:00PM. Or you can visit a branch nearest you. Check out our locations by clicking here

Examples of actions that prompt extra authentication

- Security information changes

- Username

- Password

- Enable/Disable any MFA option

- Forgot Username/Password

- External Transfers

- Zelle Transactions

- Adding Bill Pay Payee

- Card Management Changes

- Using a new computer or smartphone

- Logging in to online banking from a new location

HOW TO:

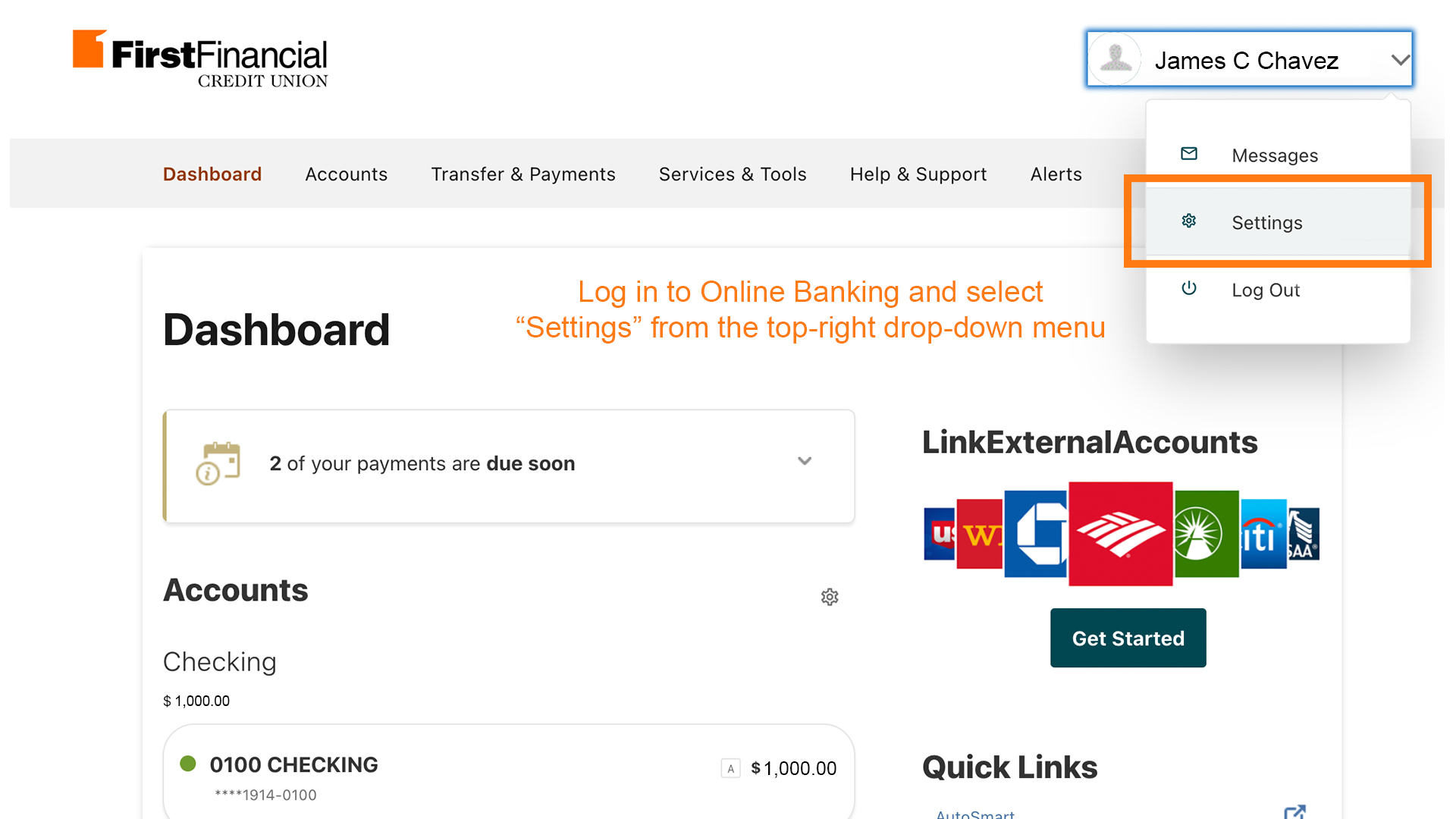

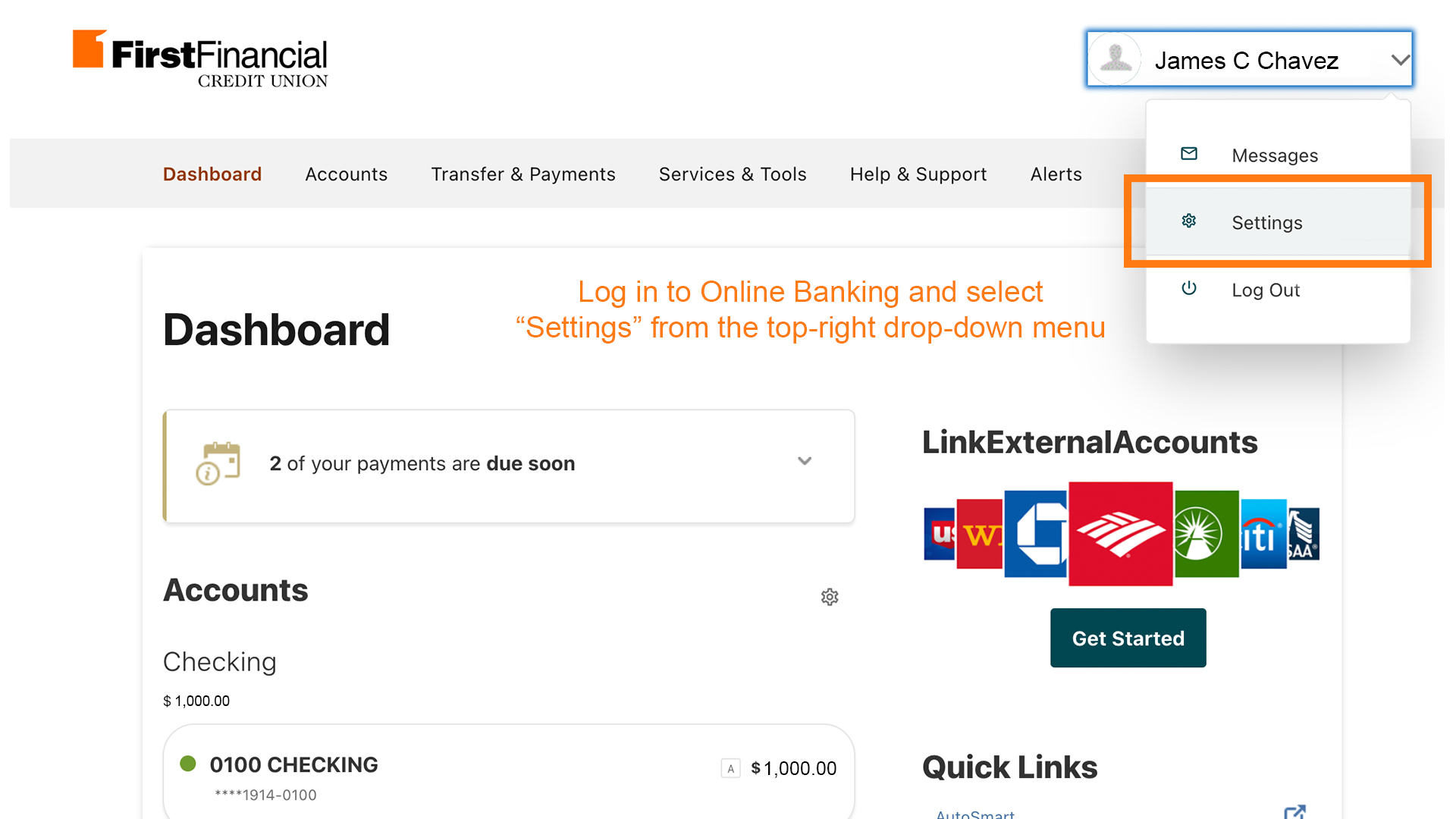

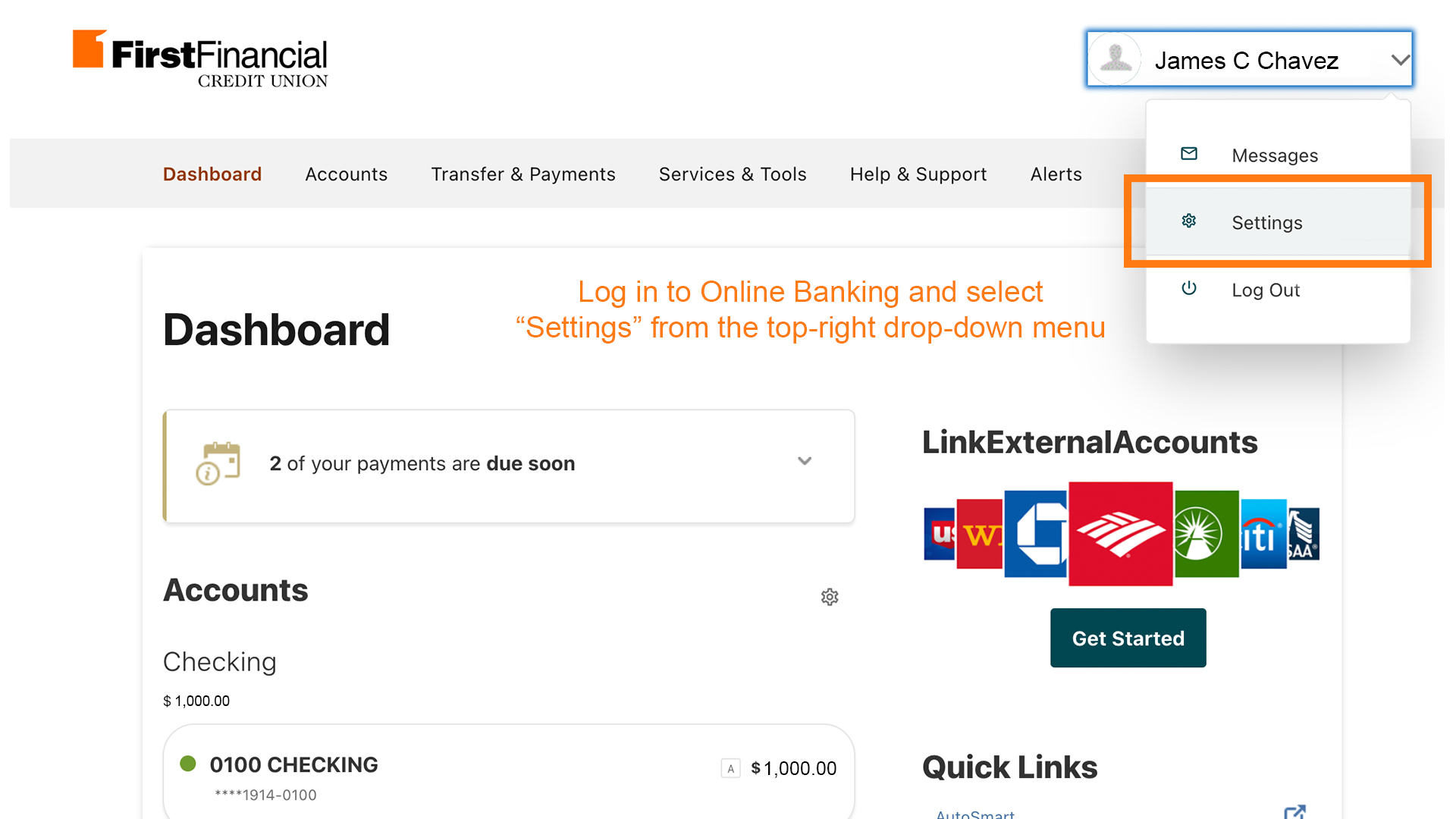

• Log in to your Online Banking and select "Settings" from the top-right drop-down menu.

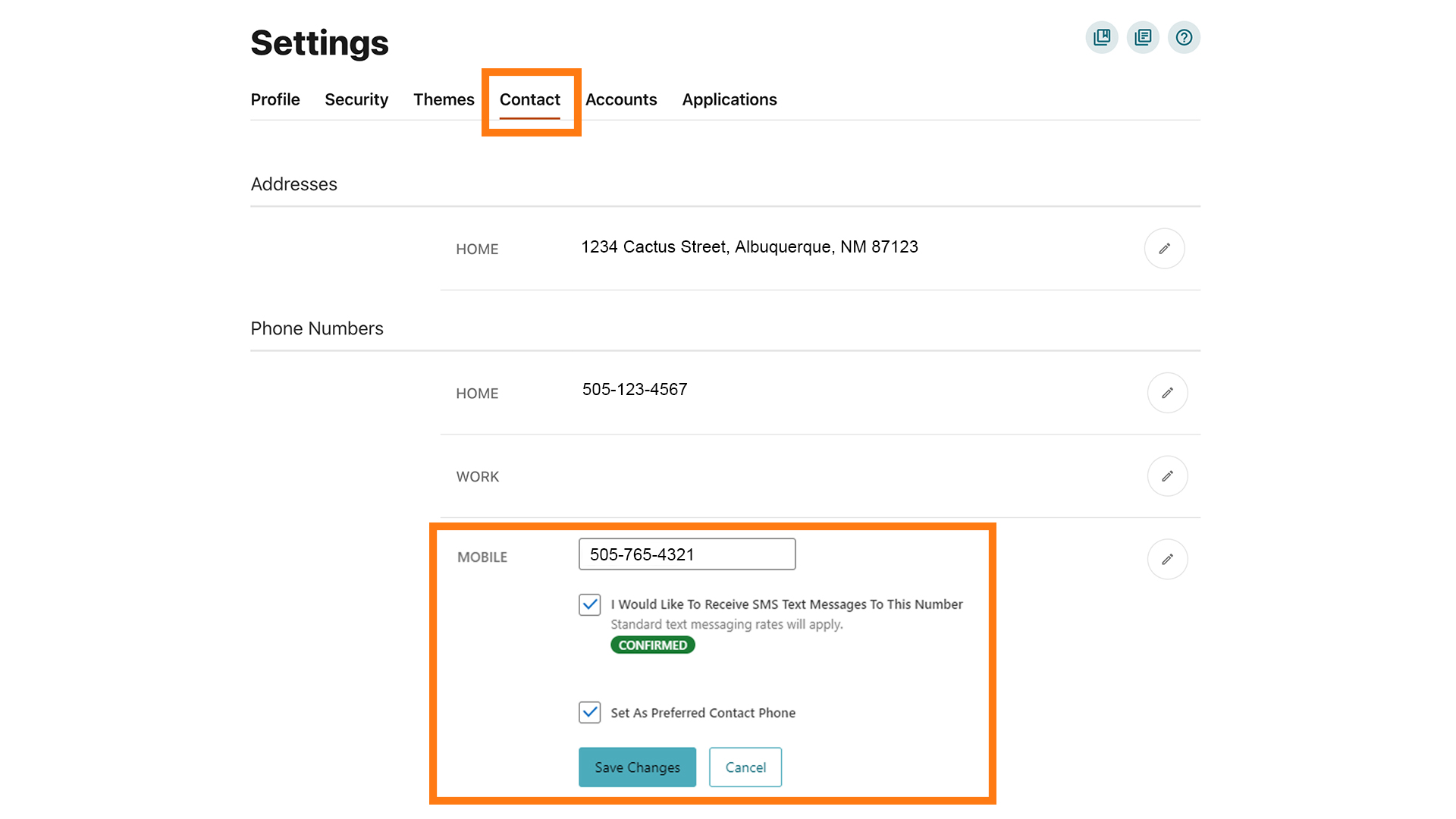

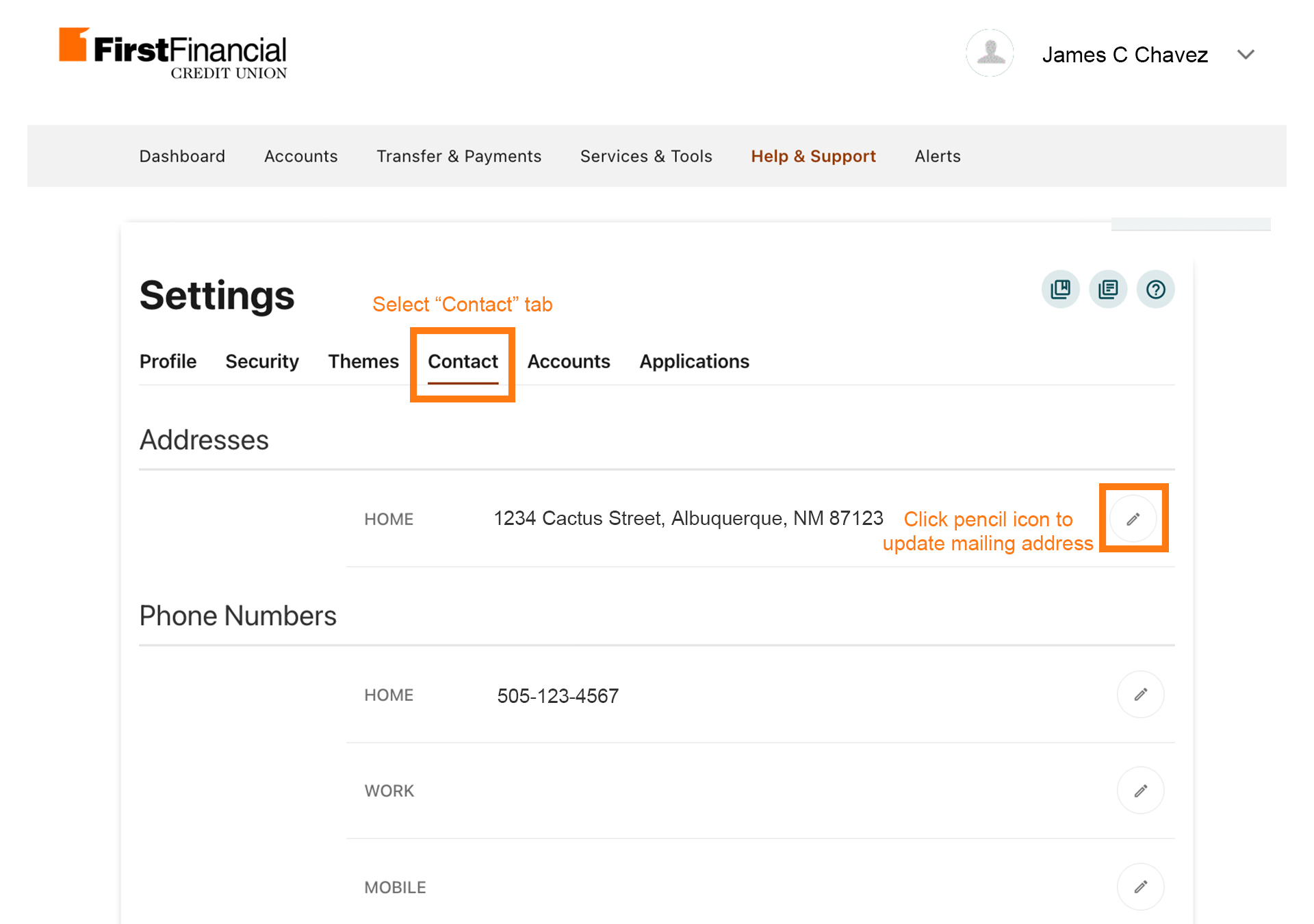

• Select Contact Tab and ensure you have a cell phone number listed in this field.

• Then select the Security tab. Two factor authentication for each login is optional but this is where you can select SMS/Text authenticator App for transactions that for require additional authentication.

Verifying Your Email Address

First Financial Credit Union will often mail important financial information, documents, and financial instruments such as notices, statements, checks, debit/ATM cards, and credit cards. It is imperative we have your correct mailing address on file to ensure a safe delivery of your financial information.

You can verify and update your address using the below options:

-

Via Online Banking using the steps listed below

-

Sending a secured email via Online/Mobile Banking

Log in to Online Banking -

Calling our Member Resource Center

505-766-5600 or 1-800-342-8298

{endAccordion}

Updating Personal Information in Online Banking

{beginAccordion}

Read More

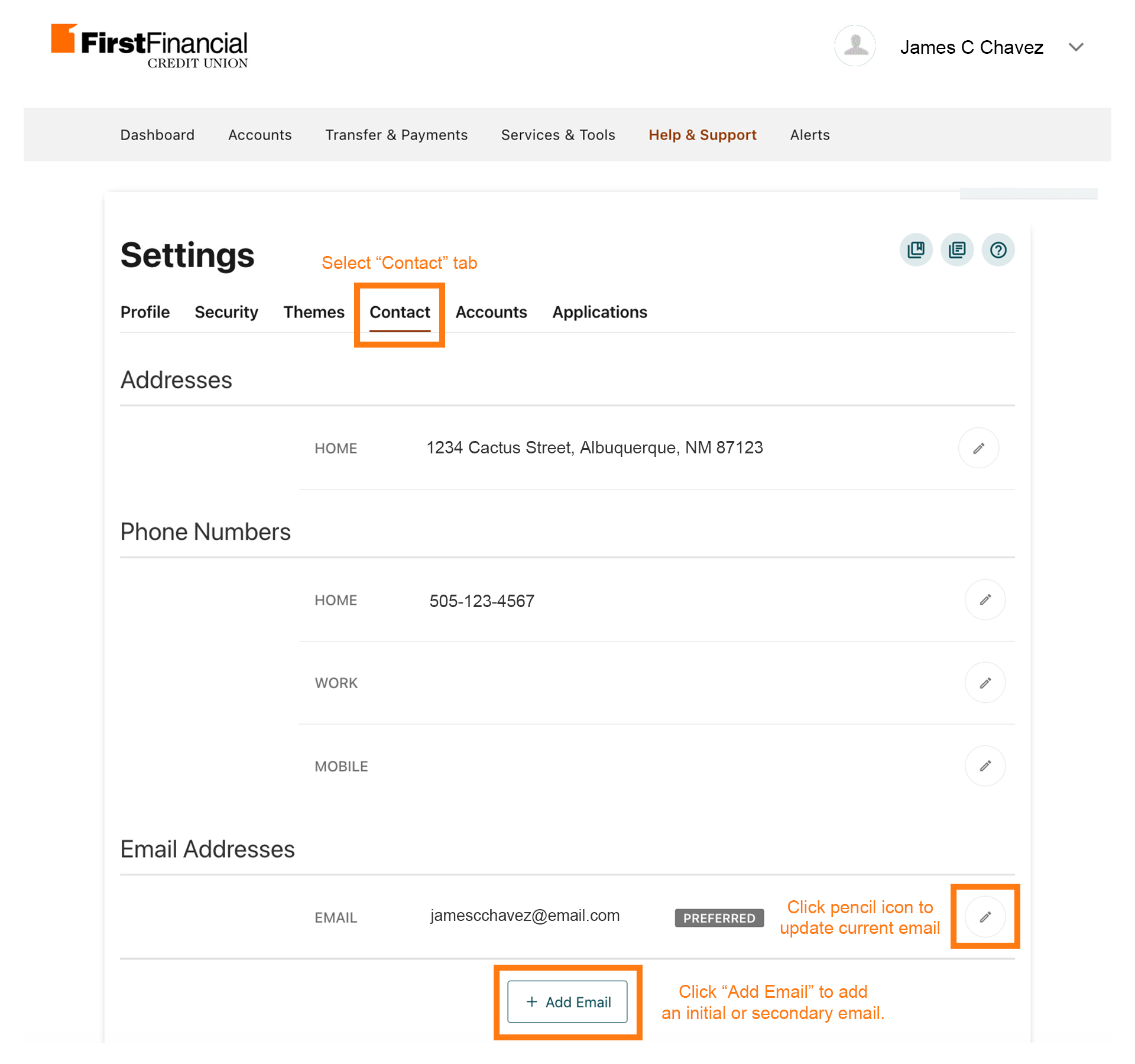

Updating Your Email

• Log in to your Online Banking and select "Settings" from the top-right drop-down menu.

• Scroll down to the "Email" section. Select the pencil icon on right-hand side to edit/udpate current email address on file or select "Add Email" at bottom of page to add an intitial or secondary email.

• Click "Save" when you are done!

Updating Your Mailing Address

• Log in to your Online Banking and select "Settings" from the top-right drop-down menu.

• Scroll to the "Address" section. Select the pencil icon on right-hand side to edit/update current mailing address on file.

• Click "Save" when you are done!

{endAccordion}