1. Online/Mobile Banking Unavailable Sun., April 27th, from 7 am to 10 am for system maintenance.

2. SCAM ALERTS! We take our members’ privacy very seriously. We will never ask for your account information in an email, text message, or over the phone.

-

Social Security Scam

Scammers are posing as the Social Security Administration (SSA) and other government agencies, attempting to steal your personal information and money. SSA will never call you, do not provide any information and hang up the phone.

How to Spot the Scam:

-

- Calls, emails, or texts claiming your Social Security number is suspended or you owe a fine.

- Threats of arrest, legal action, or loss of benefits if you don’t comply.

- Requests for payment via gift cards, wire transfers, or cryptocurrency.

- Fake caller ID showing “Social Security” or another government agency.

What to Do:

-

- Do not provide personal information or payment.

- Hang up and report the scam to the FTC at ReportFraud.ftc.gov or call the SSA Fraud Hotline at 1-800-269-0271.

- Verify claims by calling SSA directly at 1-800-772-1213.

Stay alert and spread the word! The government will never threaten you or demand immediate payment.

-

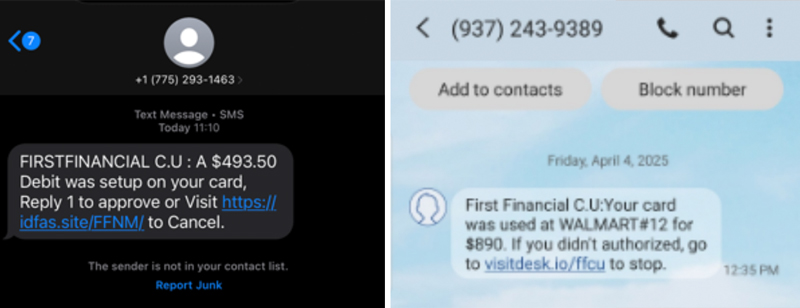

Text Scam

Members receiving texts posing as FFCU fraud with a link to confirm charges. This is a scam.

Examples:

What to Do:

-

- Do not click the link or provide any personal information.

- Contact our member resource center if you believe you have been compromised.

3. It is important that you provide the correct MICR Number for Direct Deposit & Tax Returns.

Our goal at FFCU is to ensure your direct deposits or tax refunds post correctly and timely into the account you are intending them to. To avoid any delays or rejects, it is important that you provide the correct MICR (Magnetic Ink Character Recognition) Number to your employer (for direct deposit) or your tax attorney/CPA (for tax returns). A MICR Number is your bank account number with preceding digits added that identifies the exact account (Savings, Checking, Auto Loan, Personal Loan) where the funds will be credited/debited. This means that you will have a different MICR Number for each of your FFCU accounts and loans. To support you, we provide the full MICR Number on each of your accounts/loans, with us, via online and mobile banking. Please confirm you are using the correct MICR Number, before authorizing any ACH (Automatic Clearing House), Direct Deposit or Payments.

To find the correct MICR Number via ONLINE banking, please follow these steps:

- Log into your online banking

- Click on the account or loan you want your ACH to post to, on the left-hand side.

- Click on Account Details in the middle of the page above your transactions.

- Find MICR ACCOUNT NUMBER at the bottom

- This is exactly what you need to provide to your employer, Tax Attorney or CPA to ensure your payments, deposits and tax returns post on time and to the right account.

To find the correct MICR Number via MOBILE banking, please follow these steps

- Log into your mobile banking

- Click on the account or loan you want the ACH to post to.

- Click on SHOW DETAILS in the upper right-hand corner.

- Find the MICR ACCOUNT NUMBER at the bottom.

If you do not have access to online or mobile banking, please feel free to contact us at (505)766-5600 or visit a branch and our staff will be happy to provide you with information you need. Thank You